Certificate Of Deposit Rates

We believe in delivering the perfect client experience and place the highest priority on protecting your confidential information. For security purposes, we have temporarily suspended online access to your account.

Certificate Of Deposit Rates Wells Fargo

To access your account, please:

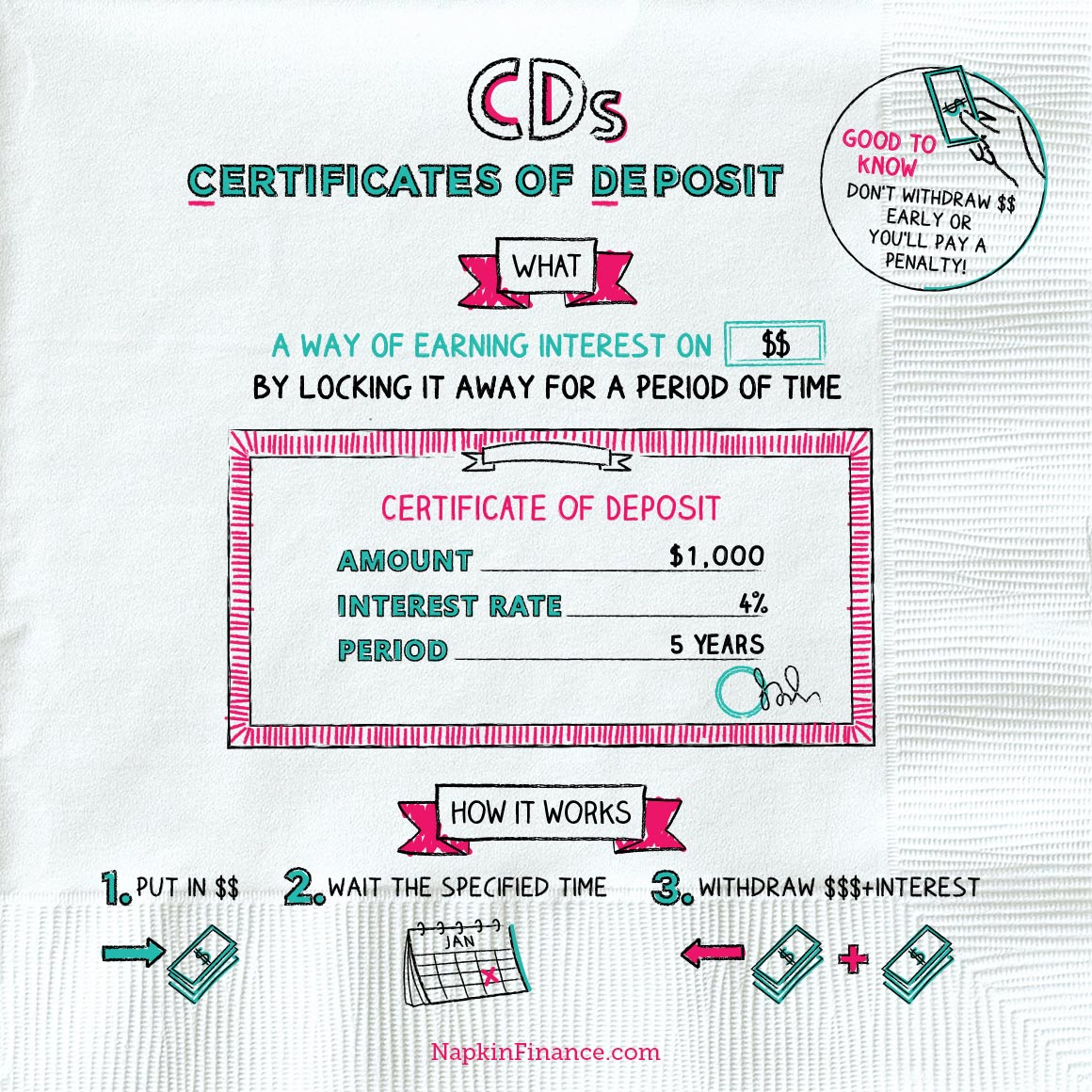

CDs allow you to save money with a fixed interest rate for a fixed amount of time, called a term. Capital One CD terms range from 6 months to 60 months. In exchange for leaving your money in the account, you earn interest on the money you deposit. Lafayette Federal Credit Union offers both variable rate and fixed rate certificates of deposit, but its crown jewel is certainly its 1-year fixed rate CD, with an APY of 0.80%. For this product, a $500 minimum deposit.

- Visit a BB&T branch or ATM

- Log in to the U by BB&T® mobile app

- Send a text to MYBBT (69228) (if you have a mobile number registered with BB&T)

- Call our online banking support at 888-228-6654 and provide us the reference code below

Reference Code: (18.c6641102.1615060028.1edbbba7)

Thank you for your patience, and please accept our apologies for any inconvenience this may have caused.

Savings rates as of March 1, 2021

Dividends are calculated on a daily balance, and credited and compounded monthly. Dividend rates and annual percentage yields (APY) may be changed monthly after the account is opened, based on market conditions. Withdrawals and service charges may reduce earnings.

Please contact us about fees, terms or for more information about any of these accounts.

Deposit & Share Certificate Rates

General Savings

| Account | Dividend Rate | APY | |

|---|---|---|---|

| Membership Savings | |||

| $5 minimum opening deposit. | 0.25% | 0.25% | |

| Preferred Checking | |||

| No minimum balance to open or earn dividends. | 0.10% | 0.10% | |

| Legacy Select Checking | |||

| No minimum balance to open. Earn dividends each day the balance is $500 and above. | 0.10% | 0.10% | |

| Legacy Checking Accounts are accounts established at WESTconsin Credit Union prior to January 1, 2021. These accounts will no longer be available to open as new accounts after January 1, 2021 | |||

| Legacy AddsUp Checking | |||

| Balance up to $15,000. | 1.50% | 1.51% | |

| Balance more than $15,000. | 0.25% | 0.25% | |

| If qualifications are not met. | 0.25% | 0.25% | |

| Legacy Checking Accounts are accounts established at WESTconsin Credit Union prior to January 1, 2021. These accounts will no longer be available to open as new accounts after January 1, 2021 | |||

| Business Checking | |||

| Earn dividends each day the balance is $500 and above. | 0.10% | 0.10% | |

| Savings | |||

| No minimum balance to open or earn dividends. | 0.25% | 0.25% | |

| Youth Savings | |||

| Balance up to $2,500 | 2.00% | 2.02% | |

| Balance more than $2,500 | 0.25% | 0.25% | |

| Christmas Club | |||

| No minimum balance to open or earn dividends. | 0.25% | 0.25% | |

| Funeral Trust | |||

| No minimum balance to open or earn dividends. | 0.25% | 0.25% | |

| HSA Checking | |||

| $0-$9,999.99 | 0.25% | 0.25% | |

| $10,000 and more | 0.50% | 0.50% | |

Money Market

| Account | Dividend Rate | APY | |

|---|---|---|---|

| $0-$9,999.99 | 0.25% | 0.25% | |

| $10,000-$24,999.99 | 0.35% | 0.35% | |

| $25,000-$49,999.99 | 0.40% | 0.40% | |

| $50,000-$99,999.99 | 0.45% | 0.45% | |

| $100,000 and more | 0.50% | 0.50% | |

| No minimum balance to open. | |||

Achieve Money Market

| Account | Dividend Rate | APY | |

|---|---|---|---|

| $0-$24,999.99 | 0.30% | 0.30% | |

| $25,000 and more | 0.50% | 0.50% | |

| |||

Certificate Of Deposit Rates Capital One

Annual Percentage Yields (APY)

Share CertificatesandIRAscan be automatically renewed. Annual percentage yields (APYs) subject to change. Early withdrawal penalty: 90 days dividends on 3-12 month terms, 180 days on 18-24 month terms, 365 days on 36-60 month term,Health Savings Accountsand IRAs. Dividends are calculated on a daily balance, and credited and compounded monthly. Dividend rates and APYs may be changed monthly after the account is opened, based on market conditions. Withdrawals and service charges may reduce earnings. Rates/APY subject to change.

PleaseWESTconsincu.org/contact-service-center/' tabindex='211'>contact usabout fees, terms or for more information about any of these accounts.

Share Certificates and IRAs

Credit Union Cd Rates 3% Or Better

| Deposit Amount | Basic MVP* Level | Silver MVP* Level | Gold MVP* Level | |||||

|---|---|---|---|---|---|---|---|---|

| Term | Compounded | Minimum Balance to Open & Earn APY | Dividend Rate | APY | Dividend Rate | APY | Dividend Rate | APY |

| 3 month | @Maturity | $5,000.00 | 0.25% | 0.25% | 0.40% | 0.40% | 0.60% | 0.60% |

| 6 month | Monthly | $1,000.00 | 0.30% | 0.30% | 0.45% | 0.45% | 0.65% | 0.65% |

| 12 month | Monthly | $1,000.00 | 0.35% | 0.35% | 0.50% | 0.50% | 0.70% | 0.70% |

| 18 month | Monthly | $1,000.00 | 0.40% | 0.40% | 0.55% | 0.55% | 0.75% | 0.75% |

| 24 month | Monthly | $1,000.00 | 0.45% | 0.45% | 0.60% | 0.60% | 0.80% | 0.80% |

| 36 month | Monthly | $1,000.00 | 0.50% | 0.50% | 0.65% | 0.65% | 0.85% | 0.85% |

| 36 month Step-Up | Monthly | $5,000.00 | 0.40% | 0.40% | 0.55% | 0.55% | 0.75% | 0.75% |

| 48 month | Monthly | $1,000.00 | 0.60% | 0.60% | 0.75% | 0.75% | 0.95% | 0.95% |

| 60 month | Monthly | $1,000.00 | 0.75% | 0.75% | 0.90% | 0.90% | 1.10% | 1.11% |

| 18 month Fixed Rate IRA | Monthly | $500.00 | 0.40% | 0.40% | 0.55% | 0.55% | 0.75% | 0.75% |

| 60 month Fixed Rate IRA | Monthly | $500.00 | 0.70% | 0.70% | 0.85% | 0.85% | 1.05% | 1.06% |

| 18 month Variable Rate IRA | Daily | $50.00 | 0.56% | 0.56% | 0.56% | 0.56% | 0.56% | 0.56% |

| 12 month Fixed Rate Health Savings | Monthly | $500.00 | 0.35% | 0.35% | 0.50% | 0.50% | 0.70% | 0.70% |

3% Cd Rates Fdic Insured

*Reach Membership Value Pricing (MVP) Level with direct deposit into an active WESTconsin personal checking account and $15,000 in balances for Silver, or $30,000 or a first mortgage real estate loan for Gold.