Fscs Protection

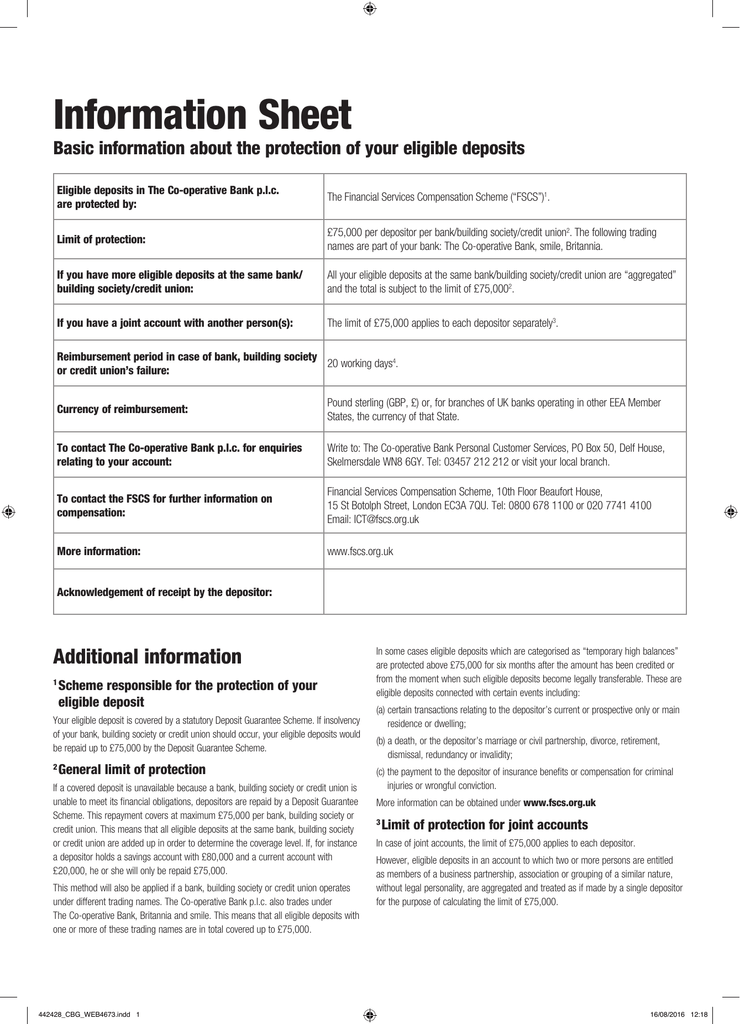

If your bank or building society fails and can’t pay back your money, FSCS can automatically pay you compensation. Your bank or building society must be authorised by the Prudential Regulation Authority - check this on the Financial Services Register.

About FSCS FSCS is here to protect your money. It is the body which gives you automatic protection up to £85,000 if your bank, building society or credit union goes out of business; and you’ll normally get your money back within seven days. FSCS is funded by the financial services industry and is free to.

- FSCS protects temporary high balances in your bank account, building society account or credit union account of up to £1million for 6 months. The protection begins from the date the temporary high balance is credited to an individual depositor's account, or to a client's account on an individual's behalf. This date may be earlier than the date the temporary high balance was credited to your account with the failed.

- LIST OF BANKING AND SAVINGS BRANDS PROTECTED BY THE SAME FSCS COVERAGE COMPILED BY THE BANK OF ENGLAND AS AT 05 DECEMBER 2019 Banking and Savings Brand PRA-authorised institution FRN Other deposit brands covered by FSCS coverage 512956 AA Savings. 512956 Post Office Money 512956 Bank of Ireland (UK) Plc 512956 Bank of Ireland (UK).

- FSCS is committed to ensuring the security of your personal information and to giving you control over how your data is used. In response to changes to European data regulation known as GDPR, the FSCS privacy notice has been updated.

Where you hold your money could affect how much compensation you’re entitled to. If you have money in multiple accounts with banks that are part of the same banking group (and share a banking licence) we have to treat them as one bank. This means that our compensation limit applies to the total amount you hold across all these accounts, not to each separate account.

For our compensation limit to apply to each individual account, you’d need to hold money with different banks that don’t share a licence. You can search the financial services register on the Financial Conduct Authority’s website to see which banks share a licence or download this list of banks that share a license (pdf 0.3MB) from the Bank of England.

You can easily see how much of your money is protected by using our protection checker. Click the button to get started.

Fscs Protection Limits

If you hold money with a UK-authorised bank, building society or credit union that fails, we’ll automatically compensate you.

- up to £85,000 per eligible person, per bank, building society or credit union.

- up to £170,000 for joint accounts.

We protect certain qualifying temporary high balances up to £1 millionfor 6 months from when the amount was first deposited.

You don’t need to do anything – FSCS will compensate you automatically.

You can easily see how much of your money is protected by using our protection checker.

How long will a claim against a failed bank or building society take?

7 days

I used a savings marketplace/cash platform to deposit my money in multiple accounts with different banks. How long will my claim take?

Fscs Protection

I’ve got a small business account and a personal account with the same bank - are both accounts covered up to £85,000?

If your business is a separate legal entity, e.g., a limited company or LLP, you could claim up to £85,000 for each account. If you’re a sole trader (e.g., Mr Smith t/a Smith Motors) you wouldn’t be entitled to two separate claims – you could claim up to £85,000 in total.

Although joint account holders are usually entitled to make separate deposit claims for £85,000 each, if the joint account holders hold the account as partners in a business, then the business partnership is only entitled to a single claim of £85,000 (not one claim per business partner).

See our small businesses, limited companies and charities page for more information.

Financial Services Compensation Scheme

Are deposits covered if they’re held in a client account, or by a nominee company?

See our answer on whether we cover deposits held in client accounts.

Fscs Protection Limit

Placeholder for question

Fscs Protection Pensions

This website uses cookies. By using the FSCS website, you consent to the use of cookies in accordance with our cookie policy. You can change your browser settings to disable cookies at any time but if you do so, parts of the FSCS site may not function properly. FSCS is committed to ensuring the security of your personal information and to giving you control over how your data is used. In response to changes to European data regulation known as GDPR, the FSCS privacy notice has been updated. This website uses cookies. By using the FSCS website, you consent to the use of cookies in accordance with our cookie policy. You can change your browser settings to disable cookies at any time but if you do so, parts of the FSCS site may not function properly. FSCS is committed to ensuring the security of your personal information and to giving you control over how your data is used. In response to changes to European data regulation known as GDPR, the FSCS privacy notice has been updated. This website uses cookies. By using the FSCS website, you consent to the use of cookies in accordance with our cookie policy. You can change your browser settings to disable cookies at any time but if you do so, parts of the FSCS site may not function properly. FSCS is committed to ensuring the security of your personal information and to giving you control over how your data is used. In response to changes to European data regulation known as GDPR, the FSCS privacy notice has been updated.